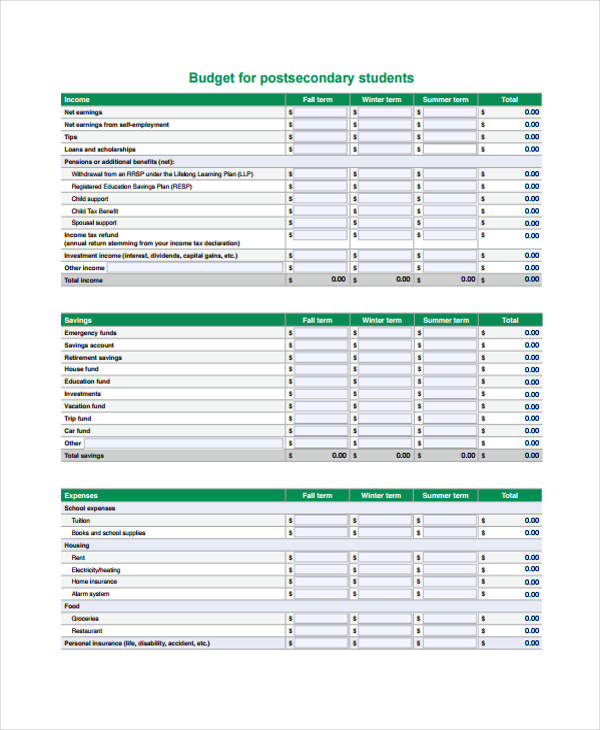

The template may NOT be sold, distributed, published to an online gallery, hosted on a website, or placed on any server in a way that makes it available to the general public. Licensed for Private Use Only (not for distribution or resale) Rows limit: Income: 15 rows, Expenses: 50 rows.

#Personal budget plan sample how to#

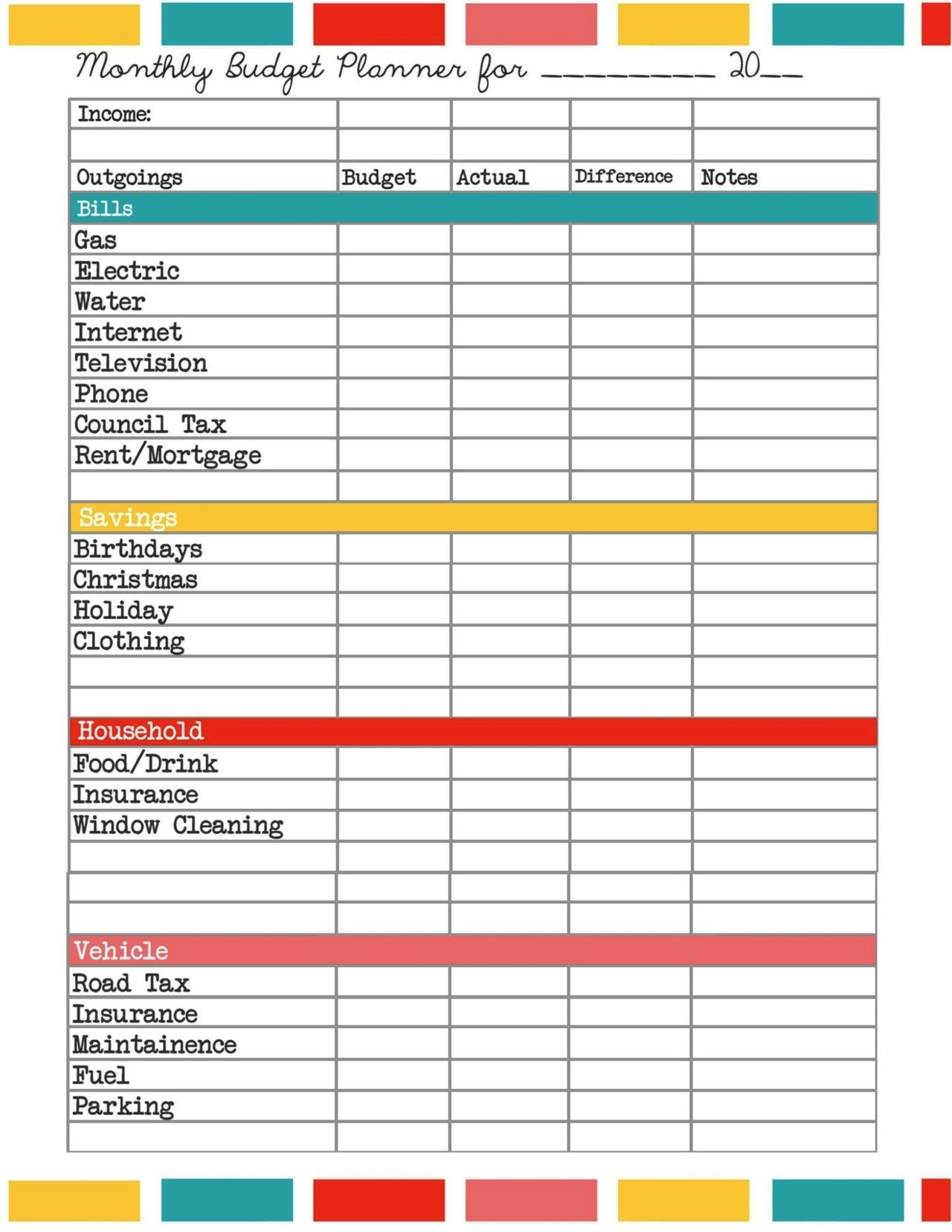

Knowing how to manage a budget keep track of where every pound is being spent is a great first step to starting your savings, getting out of debt or preparing for retirement. Reports: Overview, Expenses by Category, Expenses by Subcategory Our free budget calculator will help you to know exactly where your money is being spent, and how much you’ve got coming in.Experts advise that we should all save at least 10% of our total income.

That’s it! Now that you have the income and fixed expenses, you can predict irregular or variable expenses such as eating out, clothing and fuel.

If the bills amount varies, such as a phone or electricity bill, just enter an average value for forecasting and change it when you know the real value. List any recurring monthly expenses (mortgage/rent, utilities, property tax and insurance). Enter all income, such as your salary or commission.Ģ. One template ready to receive your dataġ.

0 kommentar(er)

0 kommentar(er)